2024 South Africa Budget and Tax Guide

|

2024 Budget Documents for Download:

Budget Speech by Finance Minister Budget Highlights Tax Pocket Guide People's Guide Source: National Treasury |

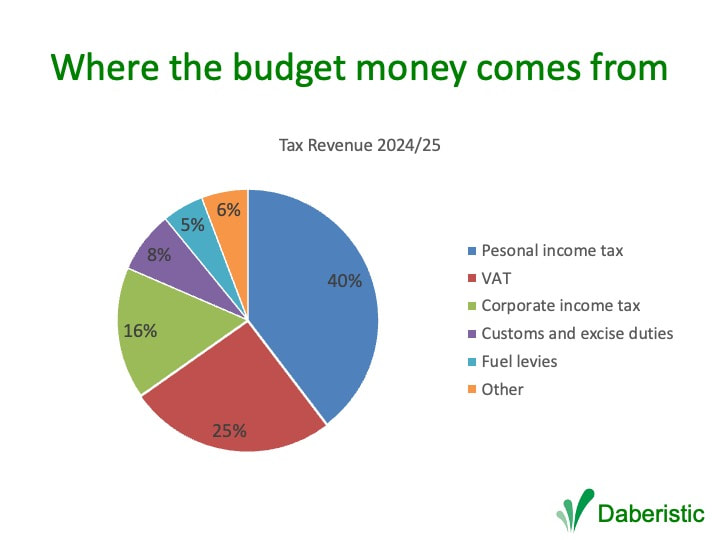

Minister of Finance Enoch Godongwana announced his pre-election South Africa government budget for 2024-2025 on the 21st of February 2024. The infographic below shows where the budget money comes from.

Individuals continue to shoulder the most responsibilities in terms of highest contribution to the fiscus, followed by VAT and corporates.

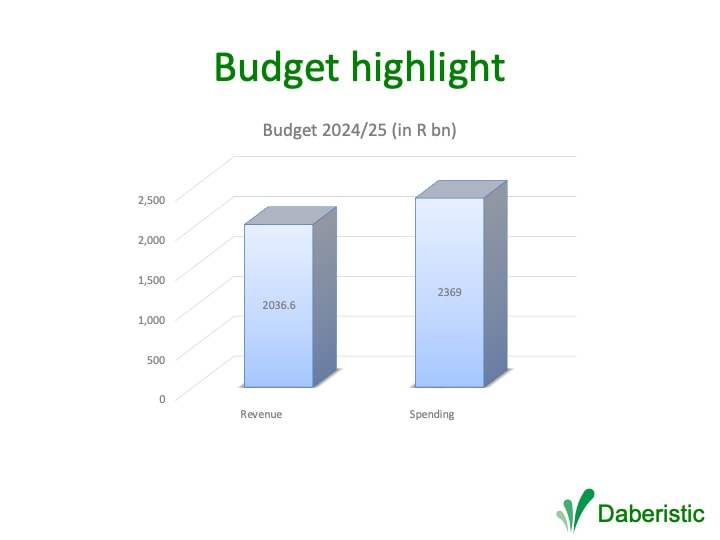

The budget income for 2024/25 is R2.04 trillion, and spending R2.37 trillion, leading to a deficit of R332.4 billion.

Budget framework |

|

Spending programmes |

|

Tax proposals |

|

Income tax: Individuals

For under age 65, if the annual income is below R95,750, no income tax is payable. Tax threshold for over 65: R148,217. For over 75: R165,689.

Interest and dividend income:

Annual exemption on interest R23,800 (age <65) and R34,500 (age 65+) (no change)

Capital Gains Tax: (no change)

Individuals inclusion rate 40%; effective highest tax rate 18% (increased from 16.4%)

Companies and trusts inclusion rate 80%: companies effective tax rate 21.6%, trusts 36%

Retirement fund contributions: (no change)

Individuals allowed 27.5% of the higher of taxable income or employment income as deduction, for contributions to pension, provident and retirement annuity funds.

Maximum annual deduction R350,000

Currently retirement fund members have to purchase annuity with at least 2/3rds of their retirement benefit; threshold remains R247 500.

Medical aid tax credit:

R364 per person for the first two people on medical aid, thereafter R246 per person per month. The table below illustrates:

Interest and dividend income:

Annual exemption on interest R23,800 (age <65) and R34,500 (age 65+) (no change)

Capital Gains Tax: (no change)

Individuals inclusion rate 40%; effective highest tax rate 18% (increased from 16.4%)

Companies and trusts inclusion rate 80%: companies effective tax rate 21.6%, trusts 36%

Retirement fund contributions: (no change)

Individuals allowed 27.5% of the higher of taxable income or employment income as deduction, for contributions to pension, provident and retirement annuity funds.

Maximum annual deduction R350,000

Currently retirement fund members have to purchase annuity with at least 2/3rds of their retirement benefit; threshold remains R247 500.

Medical aid tax credit:

R364 per person for the first two people on medical aid, thereafter R246 per person per month. The table below illustrates:

Family composition |

Monthly medical aid tax credit |

Single |

R364 |

Couple |

R728 |

Couple plus 1 child |

R974 |

Couple plus 2 children |

R1,220 |

Retirement fund lump sum withdrawal benefits

No change

Lump sum amount |

Rate of tax |

< R27,500 |

0% |

R27,501 – R726,000 |

18% |

R726,001 – R1,089,000 |

27% |

Amount above R1,089,000 |

36% |

Retirement fund lump sum benefits or severance benefits

No change; effectively an increase in tax rate in real terms over last few years

Lump sum amount |

Rate of tax |

< R550,000 |

0% |

R550,001 – R770,000 |

18% |

R770,001 – R1,155,000 |

27% |

Amount above R1,155,000 |

36% |

Individuals income tax table

South Africa has a progressive personal income tax system. The more a person's income, the higher the rate of tax at which he pays on his income. Increases in income brackets are welcomed, to provide tax relief to burdened individual taxpayers.

Taxable income |

Rate of tax |

R0 – R237,100 |

18% |

R237,101 – R370,500 |

26% |

R370,501 – R512,800 |

31% |

R512,801 – R673,000 |

36% |

R673,001 – R857,900 |

39% |

R857,901 – R1,817,000 |

41% |

Above R1,817,001 |

45% |

Rebates: Primary R17,235, Secondary (for ages 65 and above) R9,444, Tertiary (for ages 75 and above) R3,145.

Estate duty: 20% on the first R30 million, then 25% above R30 million. Primary rebate R3,500,000, plus any amount accruing to surviving spouse. (no change)

Donations tax: Annual exemption R100,000. Donations between spouses and donations to certain public benefit organisations are exempt. 20% on the first R30 million, then 25% on the cumulative value exceeding R30 million. (no change)

Estate duty: 20% on the first R30 million, then 25% above R30 million. Primary rebate R3,500,000, plus any amount accruing to surviving spouse. (no change)

Donations tax: Annual exemption R100,000. Donations between spouses and donations to certain public benefit organisations are exempt. 20% on the first R30 million, then 25% on the cumulative value exceeding R30 million. (no change)

Property transfer duty:

A welcome relief - no transfer duty for property up to R1.1 million.

Property value |

Rate of tax |

R0 – R1,100,000 |

0% |

R1,100,001 – R1,512,500 |

3% of amount above R1,100,000 |

R1,512,001 – R2,117,500 |

R12,375 plus 6% of amount above R1,512,500 |

R2,117,501 – R2,722,500 |

R48,675 plus 8% of amount above R2,117,500 |

R2,722,501 – R12,100,000 |

R97,075 plus 11% of amount above R2,722,500 |

R12,100,001 and above |

R1,128,600 plus 13% amount above R12,100,000 |

Income tax: Companies and trusts

1. Corporation: 27%

2. Small Business Corporations, turnover under R20 million

Taxable Income Rate of Tax

R95,750 0%

R95,751 – 365,000 7%

365,001 – 550,000 21%

550,001 and above 28% (27% for years of assessment ending on any date on or after 31 March2023)

3. Turnover tax for Micro Businesses

Taxable turnover Rate of tax

<335,000 0%

335,001 – 500,000 1%

500,001 – 750,000 2%

750,001 and above 3%

Turnover tax is suitable for micro businesses with an annual turnover of under R1,000,000, only need to submit returns twice a year.

2. Small Business Corporations, turnover under R20 million

Taxable Income Rate of Tax

R95,750 0%

R95,751 – 365,000 7%

365,001 – 550,000 21%

550,001 and above 28% (27% for years of assessment ending on any date on or after 31 March2023)

3. Turnover tax for Micro Businesses

Taxable turnover Rate of tax

<335,000 0%

335,001 – 500,000 1%

500,001 – 750,000 2%

750,001 and above 3%

Turnover tax is suitable for micro businesses with an annual turnover of under R1,000,000, only need to submit returns twice a year.

Residence basis of taxation |

Residents are taxed on their worldwide income, subject to certain exclusions. The general principle is that foreign taxes on foreign sourced income are allowed as a credit against South African tax payable. This is applicable to individuals, companies, close corporations, trusts and estates.

|

South Africans working abroad |

Effective from 1 March 2020, the first R1,250,000 earned from foreign service income will be exempt from tax in South Africa, provided that more than 183 days are spent outside SA in any 12-month period and, during the 183-day period, 60 days are continuously spent outside SA.

This practically means that any foreign service income above the first R1,250,000 will be taxed in South Africa at the relevant tax resident’s marginal tax rate. |

Capital Gains Tax

Maximum effective rate of tax:

Individuals and special trusts, 18%

Companies 21.6%

Other trusts 36%

Events that trigger a disposal include a sale, donation, exchange, loss, death and emigration. The following are some of the specific exclusions:

• R2 million gain or loss on the disposal of a primary residence

• Most personal use assets

• Retirement benefits

• Payments in respect of original long-term insurance policies

• Annual exclusion of R40 000 capital gain or capital loss is granted to individuals and special trusts

• Small business exclusion of capital gains for individuals (at least 55 years of age) of R1.8 million when a small business with a market value not exceeding R10 million is disposed of

• Instead of the annual exclusion, the exclusion granted to individuals is R300 000 for the year of death.

Individuals and special trusts, 18%

Companies 21.6%

Other trusts 36%

Events that trigger a disposal include a sale, donation, exchange, loss, death and emigration. The following are some of the specific exclusions:

• R2 million gain or loss on the disposal of a primary residence

• Most personal use assets

• Retirement benefits

• Payments in respect of original long-term insurance policies

• Annual exclusion of R40 000 capital gain or capital loss is granted to individuals and special trusts

• Small business exclusion of capital gains for individuals (at least 55 years of age) of R1.8 million when a small business with a market value not exceeding R10 million is disposed of

• Instead of the annual exclusion, the exclusion granted to individuals is R300 000 for the year of death.

Dividends tax

(no change) Dividends tax is a final tax at a rate of 20% on dividends paid by resident companies and by non-resident companies in respect of shares listed on the JSE. Dividends are tax exempt if the beneficial owner of the dividend is a South African company, retirement fund or other exempt person. Non-resident beneficial owners of dividends may benefit from reduced tax rates in limited circumstances. The tax is to be withheld by companies paying the taxable dividends or by regulated intermediaries in the case of dividends on listed shares. The tax on dividends in kind (other than in cash) is payable and is borne by the company that declares and pays the dividend.

Other taxes

Withholding Taxes: The following withholding taxes target non-residents:

Royalties: 15%

Interest: Effective 1 March 2015, a final tax at a rate of 15% is imposed on interest from a South African source payable to non-residents. Interest is exempt if payable by any sphere of the South African government, a bank or if the debt is listed on a recognised exchange.

Foreign entertainers and sportspersons:

A final tax at the rate of 15% is imposed on gross amounts payable to non-residents for activities exercised by them in South Africa as entertainers or sportspersons.

Disposal of immovable property:

A provisional tax is withheld on behalf of non-resident sellers of immovable property in South Africa to be set off against the normal tax liability of the non-residents. The tax to be withheld from payments to the non-residents is at a rate of 7.5% for a non-resident individual, 10% for a non-resident company and 15% for a non-resident trust that is selling the immovable property.

Value-added tax (VAT)

VAT is levied at the standard rate of 15% on the supply of goods and services by registered vendors.

A vendor making taxable supplies of more than R1 million per annum must register for VAT. A vendor making taxable supplies of more than R50 000 but not more than R1 million per annum may apply for voluntary registration. Certain supplies are subject to a zero rate or are exempt from VAT.

Securities Transfer Tax

The tax is imposed at a rate of 0.25 of a per cent on the transfer of listed or unlisted securities. Securities consist of shares in companies or member’s interests in close corporations.

Tax on International Air Travel

R190 per passenger departing on international flights excluding flights to Botswana, Lesotho, Namibia and Swaziland, in which case the tax is R100. (no change)

Skills Development Levy

A skills development levy is payable by employers at a rate of 1% of the total remuneration paid to employees. Employers paying annual remuneration of less than R500 000 are exempt from payment of the skills development levy. (no change)

Unemployment Insurance Fund (UIF)

Unemployment insurance contributions are payable monthly by employers on the basis of a contribution of 1% by employers and 1% by employees, based on employees’ remuneration below a certain amount. (no change)

Employers not registered for PAYE or SDL purposes must pay the contributions to the Unemployment Insurance Commissioner.

Estate duty

Estate duty is levied on the property of residents and South African property of non-residents less allowable deductions. The duty is 20% on the first R30 million, and 25% above R30 million.

A basic deduction of R3.5 million is allowed in the determination of an estate’s liability for estate duty as well as deductions for liabilities, bequests to public benefit organisations and property accruing to surviving spouses.

Income tax on trusts: 45%

SARS Interest Rates

Fringe benefits - interest-free or low-interest loan (official rate): 9.25%

Late or underpayment of tax 11.75%

Refund of overpayment of provisional and employees’ tax 7.75%

Refund of tax on successful appeal or where the appeal was conceded by SARS 11.75%

Customs and Excise 11.75%

Royalties: 15%

Interest: Effective 1 March 2015, a final tax at a rate of 15% is imposed on interest from a South African source payable to non-residents. Interest is exempt if payable by any sphere of the South African government, a bank or if the debt is listed on a recognised exchange.

Foreign entertainers and sportspersons:

A final tax at the rate of 15% is imposed on gross amounts payable to non-residents for activities exercised by them in South Africa as entertainers or sportspersons.

Disposal of immovable property:

A provisional tax is withheld on behalf of non-resident sellers of immovable property in South Africa to be set off against the normal tax liability of the non-residents. The tax to be withheld from payments to the non-residents is at a rate of 7.5% for a non-resident individual, 10% for a non-resident company and 15% for a non-resident trust that is selling the immovable property.

Value-added tax (VAT)

VAT is levied at the standard rate of 15% on the supply of goods and services by registered vendors.

A vendor making taxable supplies of more than R1 million per annum must register for VAT. A vendor making taxable supplies of more than R50 000 but not more than R1 million per annum may apply for voluntary registration. Certain supplies are subject to a zero rate or are exempt from VAT.

Securities Transfer Tax

The tax is imposed at a rate of 0.25 of a per cent on the transfer of listed or unlisted securities. Securities consist of shares in companies or member’s interests in close corporations.

Tax on International Air Travel

R190 per passenger departing on international flights excluding flights to Botswana, Lesotho, Namibia and Swaziland, in which case the tax is R100. (no change)

Skills Development Levy

A skills development levy is payable by employers at a rate of 1% of the total remuneration paid to employees. Employers paying annual remuneration of less than R500 000 are exempt from payment of the skills development levy. (no change)

Unemployment Insurance Fund (UIF)

Unemployment insurance contributions are payable monthly by employers on the basis of a contribution of 1% by employers and 1% by employees, based on employees’ remuneration below a certain amount. (no change)

Employers not registered for PAYE or SDL purposes must pay the contributions to the Unemployment Insurance Commissioner.

Estate duty

Estate duty is levied on the property of residents and South African property of non-residents less allowable deductions. The duty is 20% on the first R30 million, and 25% above R30 million.

A basic deduction of R3.5 million is allowed in the determination of an estate’s liability for estate duty as well as deductions for liabilities, bequests to public benefit organisations and property accruing to surviving spouses.

Income tax on trusts: 45%

SARS Interest Rates

Fringe benefits - interest-free or low-interest loan (official rate): 9.25%

Late or underpayment of tax 11.75%

Refund of overpayment of provisional and employees’ tax 7.75%

Refund of tax on successful appeal or where the appeal was conceded by SARS 11.75%

Customs and Excise 11.75%

Social grants |

18 million people receive government social grant in South Africa. This year’s budget is R387.3 billion, with the following monthly payments:

|

Type of grant |

2024 |

2025 |

State Old Age Grant |

R2,085 |

R2,185 |

State Old Age Grant, Over 75 |

R2,105 |

R2,205 |

War Veterans |

R2,105 |

R2,205 |

Disability |

R2,085 |

R2,185 |

Foster Care |

R1,125 |

R1,180 |

Care Dependancy |

R2,085 |

R2,185 |

Child Support Grant |

R505 |

R530 |

Updated on: 2024/02/21